To turn the impossible into the possible and, at the same time, provide value otherwise unseen in the history of humankind. By solving the near-impossible problems that arise within our societies – be it clean energy, efficient resource extraction, or interstellar survival – emerging ventures that seek to advance human progress not incrementally, but through 10X or 100X improvements, will propel us into a new age of value.

Idea Rules

- The first rule is that there are no rules and that there are always exceptions.

- Ideas that don’t make me go, “That sounds stupid,” but make me think, “Wow, this solution is fundamentally revolutionary and could be huge!” Gut feelings (intuition) are important in rejecting ideas, and I’d rather fund companies I get passionate about rather than ideas I think are stupid after understanding them.

- That doesn’t mean rejecting ideas that sound impossible! The largest companies in the world often did “impossible” things: Apple’s personal computers or SpaceX’s re-useable rockets. On the contrary, I believe the ventures that will define the next era of human progress border on the zone of impossibility. Market timing is everything. Can the founders convince me that novel developments in area X have allowed them to do Y for the first time ever and that it can be built? The idea can challenge my perception of impossibility but must remain grounded in the laws of physics, which are determinable.

- What are the tailwinds now and in a decade (geopolitically,1 economically, and competitively)? Can the founders convince me that this idea is not only worth it now but also in the future?

In short:

Ambitious ideas that border on impossible, but is buildable because of emerging tech, catalyzed by new demand or geopolitics, that will confer strong defensibility with obvious moats in the future in an expanding (but not necessarily large) market.

The ABCDE framework!

Sectors

My thesis is a framework of ideas that allows me to focus on the areas that not only interest me but matter the most to my worldview. It is built upon my personal perspectives on where the world and its markets are headed.

Still, I evaluate startups on a case-by-case basis, so I am not entirely opposed to startups that operate in my anti-sectors.

I primarily look to invest in atoms, accelerated by the bits. We’re past the era of making software to make businesses more efficient, and increasingly software markets are suffering crunched margins. My personal irrational philosophy is that I want to fund companies that build hardware to build the world up, enabled by technology.2

As such, startups that fit my criteria are generally deeptech, which comes with several major benefits that can be simplified as follows:

- Demand often waits.

- Success is automatic defensibility.

- High probability of new market creation.

- High barriers to entry, so less competition.3

A major critique of deeptech is that it takes too long, or is too capital-intensive.

Both are false. The deeptech era has come.

The software mindset of move fast and break things and faster iteration cycles combined with new technologies that have enabled cheap and rapid prototyping has meant that hardware startups are reaching software-level production times and costs.

As you explore the sectors I’ve laid out, I want to highlight that drastic innovation is a story of compounding exponentials. Discoveries don’t exist in isolated sectors but rather bleed into multiple ones that result in new ways to accelerate progress.

Astrophysics got much better when the tools of radio and radar met the age-old science of astronomy. The union of biology and quantum mechanics birthed molecular biology.

Many of the companies I’ve provided as examples below belong to multiple sectors (Varda, Cortical Labs, Relativity Space, etc). That is a promising sign to me.

Finally, hard ambitious startups attract and retain talent because it is easy to rally people around that mission. It attracts people who are intrinsically passionate about the problem and will work to achieve the vision despite difficult days and long nights.4

Do you want to be remembered as a lead engineer who built a better networking tool, or do you want to be remembered as the lead engineer who f#cking unlocked nuclear fusion and limitless energy for humankind?

Designed and Applied Biology

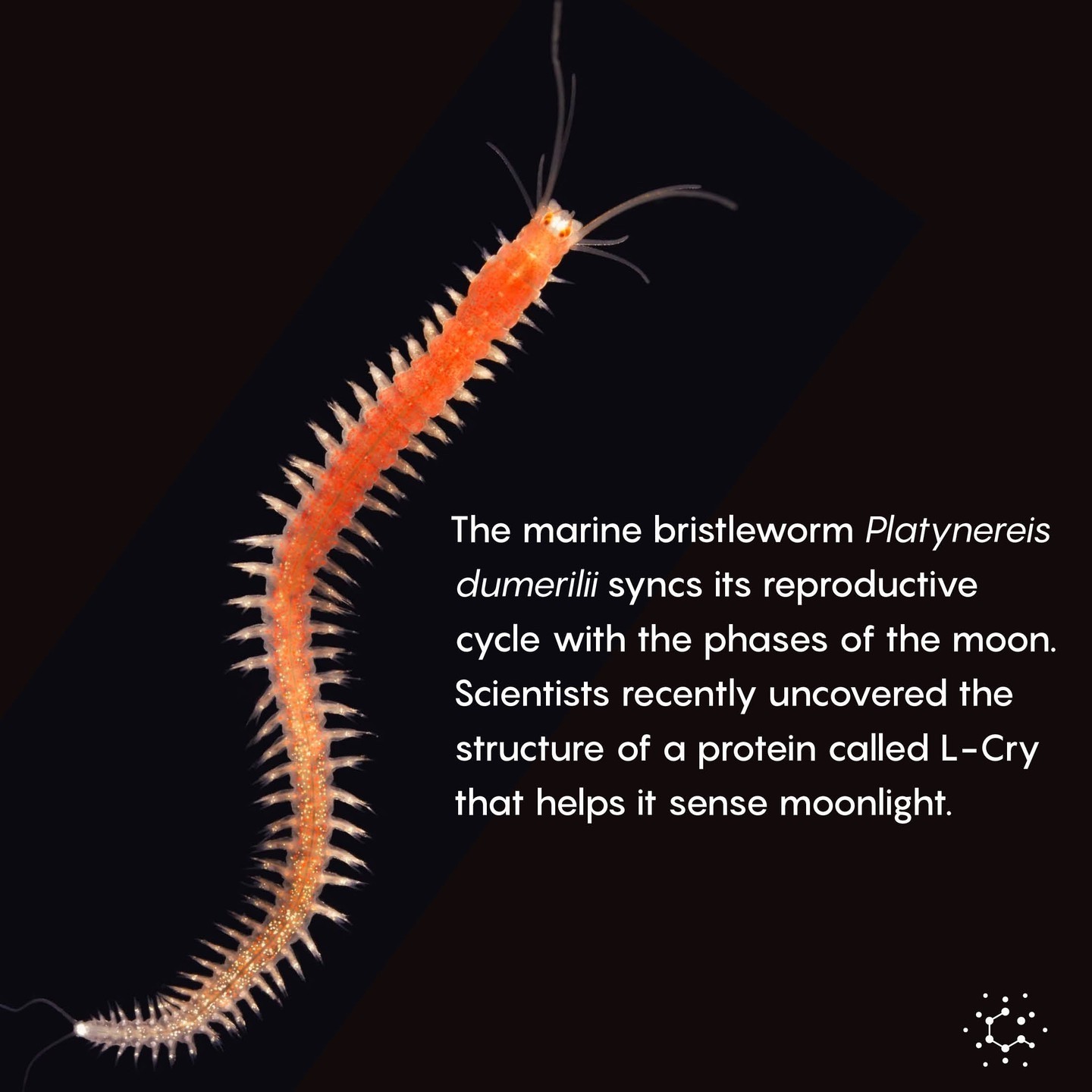

For the first time in history, emerging technologies (for example, CRISPR) have allowed us to engineer biology rather than treat biology as a science.

What does it mean to engineer biology?

Well, look at this motor:

It wasn’t designed by humans. It was designed by nature.

Nature has the capability to be engineered.

Proteins are dynamic, instruction-coded machines that exist in every living organism to serve incredible functions. As you’ve seen above, molecular engines to power motion. Or photosynthetic structures to capture solar energy. Or information systems that powers all of life. Or molecular sensors for all sorts of environmental stimuli.

Put simply, biology is the most advanced technology ever created, even beyond human ingenuity.

The lowest-hanging fruit to capture of engineered biology is in healthcare and therapeutics. Within this decade, we have advanced biology to a point where we engineer viruses and proteins to achieve a specific task we desire. Right now, it is common in the identification and eradication of cancer cells. Using CAR-T cell therapy, it isn’t unreasonable to expect that within one more generation, cancer will be a remnant of the past.

Beyond cancer, there is the manufacturing of drugs within our bodies (reprogramming immune cells) or the regeneration of damaged organs (reprogramming tissues to a younger state), which is happening at an accelerated pace.

For example, this diabetes cure released on May 2024: “Chinese scientists achieve diabetes cure through innovative cell therapy… Patient no longer requires insulin after eleven weeks, and is now medication-free for 33 months.” And in June 2024, a new type of gene therapy restored hearing in all patients with no side effects.

Both these therapies works by engineering and programming a patient’s cells. For the former, the patient’s blood cells to recreate pancreatic cells, thus artificially inducing the manufacture of insulin.

Sure, both treatments were likely very expensive (my guess is millions), and the results will need to be replicated. But as more research is done and infrastructure to support these therapies are scaled out to hospitals, these engineered biological drugs will become less expensive. The diseases that have plagued us since the dawn of human history may soon be a remnant of the past.

So, why now?

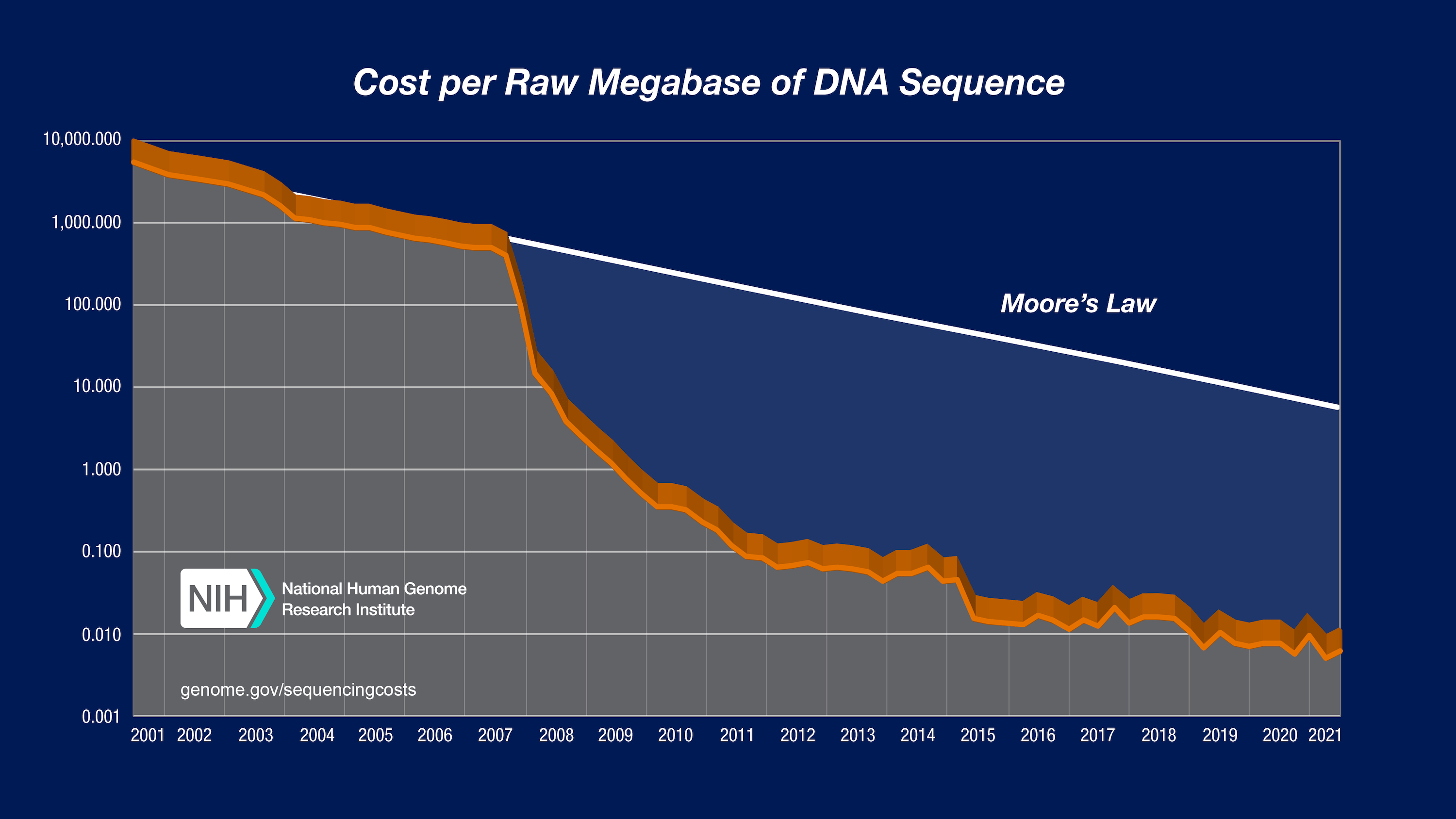

The ability to manipulate biology has reached an inflection point; it is now cost-effective to design and engineer biology to your will. As a data point, the sequencing of DNA has dropped from $10,000 in 2001 to $0.01 within 15 years. That’s a 99.999% reduction in cost. Likewise, other technologies in biotech are hitting the same benchmarks: microfluidic devices, CRISPR, and lab equipment.

Hell, even CRISPR is becoming old technology. In June 2024, two papers demonstrated bridge recombination technology, which is basically a better-than-CRISPR way to engineer genomes to human will.

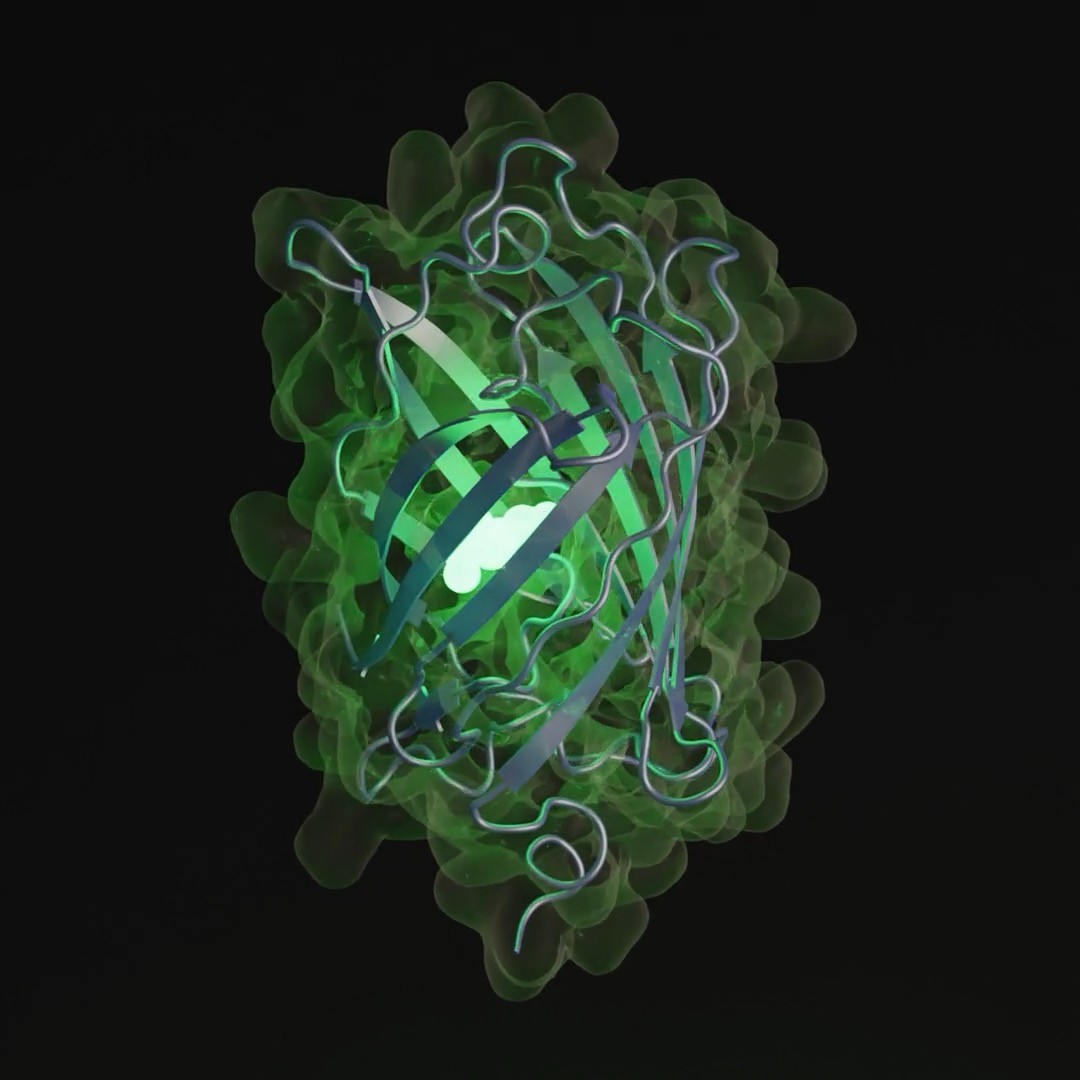

It’s also easier to engineer biology. Thanks to AI, proteins can be simulated, discovered, and engineered at unprecedented rates. On June 2024, EvolutionaryScale released ESM3, an AI model that promises to understand the code of life.

We’re excited to present ESM3—a frontier language model for the life sciences that advances our ability to program and create with the code of life. ESM3 takes a step towards the future where AI is a tool to engineer biology from first principles in the same way we engineer structures, machines and microchips, and write computer programs.

Within this decade, ESM3 and other tools will bring forth a new programming language: biology. Within this decade, scientists can leverage the enormous amounts of data we’ve gathered from biological systems to design better medicine, guided by logic and reason rather than trial and error experiments.

Already, ESM3 was able to simulate 500 million years of evolution to fold a new green fluorescent protein (esmGFP) that is distant from any other fluorescent proteins found in nature.

Costs are only high because of infrastructure bottlenecks.

In cell therapy, a patient’s cells must be extracted, transported to one of the few locations on Earth that can reprogram those specific cells, and shipped back to the patient. All while frozen and maintained. When we build a better network of facilities or improve cell therapy infrastructure, we may soon reprogram a patient’s cells in the next room from where they were extracted.

But we can do much more.

Engineered biology will ultimately descend to tackle the final frontier of biology: longevity and aging. Once the technology is proven, It will perhaps grow to become the biggest market in the world – because the TAM for longevity is, well, everyone. And everyone wants to live longer.

Wait, I don’t want to live forever! That sounds boring!

You’re right. People don’t want to live forever. I don’t want to live forever.

But everyone does want just a bit more time:

- Being with their loved ones.

- Spending more time playing with their grandchildren after they retire.

- Learning new hobbies they never had time for before.

- Feeling young and energetic even in their 80s.

This is important because the average time a person has with a healthy, functional body is around 65 years. The first 20 years is your education. The latter 40 years is your career. The last 5 years are your time to enjoy life before it goes downhill.

In circumspect, that’s fucking depressing.

Engineered biology can and will extend that last phase to 10, even 20 years. If we can extend the lifespan of the average human through the eradication of age-related diseases, we will not only save money, but make every other industry larger through the enjoyment of travel, hobbies, and overall spending.

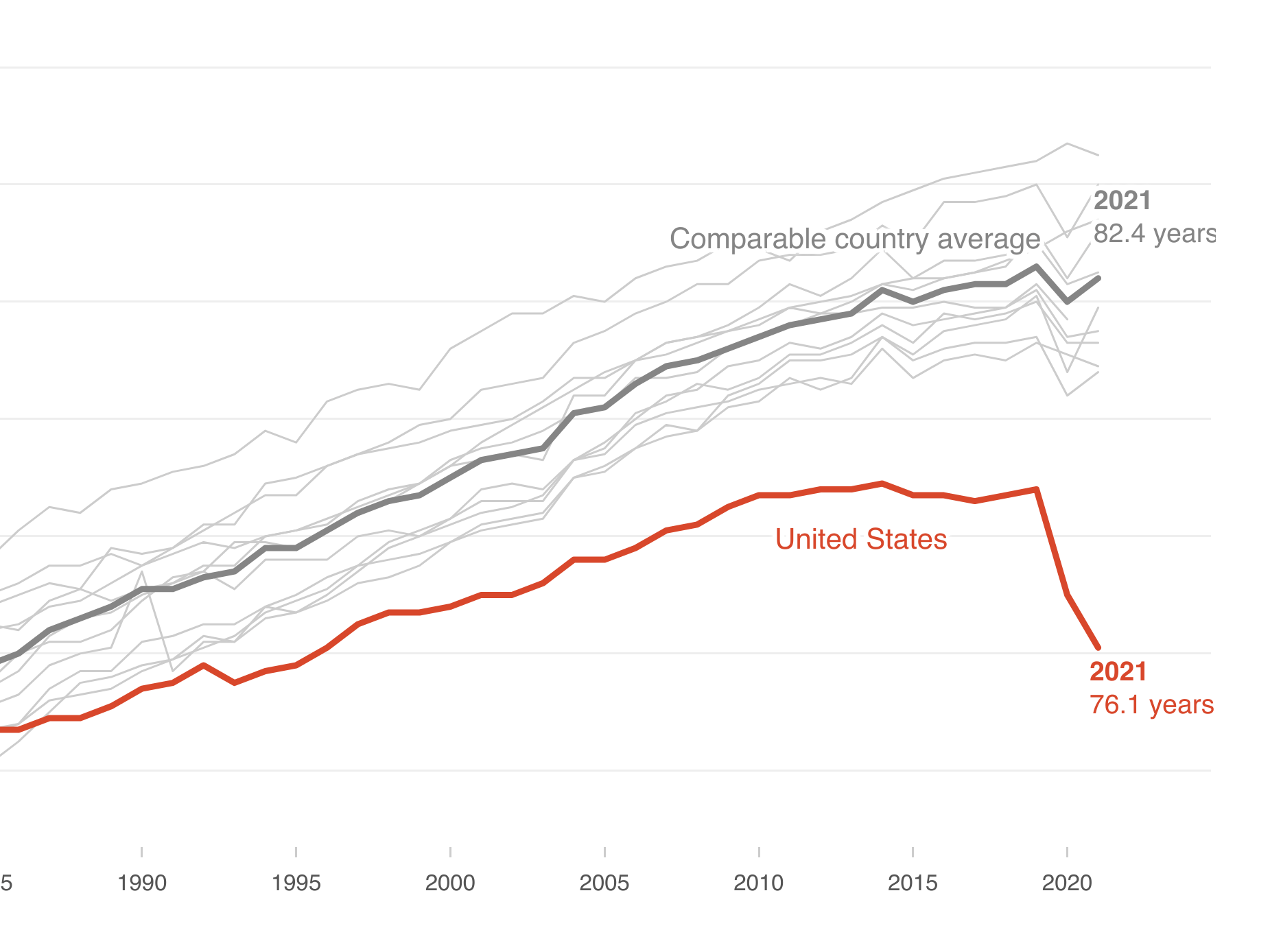

In the past 100 years, we’ve nearly doubled the human lifespan. Yet, this progress has stalled – in fact, life expectancy has gone down in America (partly due to COVID).

It is time to rekindle this growth through the advancement of engineered biology. Lizards can regenerate their tails. The immortal jellyfish can biologically live forever. I believe the next wave of engineered biologics companies will push the frontiers of biology to a point where we can leverage these examples in nature for the betterment of society.

Promising companies in the applied biology space:

Cosmic Infrastructure

As the global economy evolves, space technologies are poised to become one of the most promising frontiers for investment and innovation.

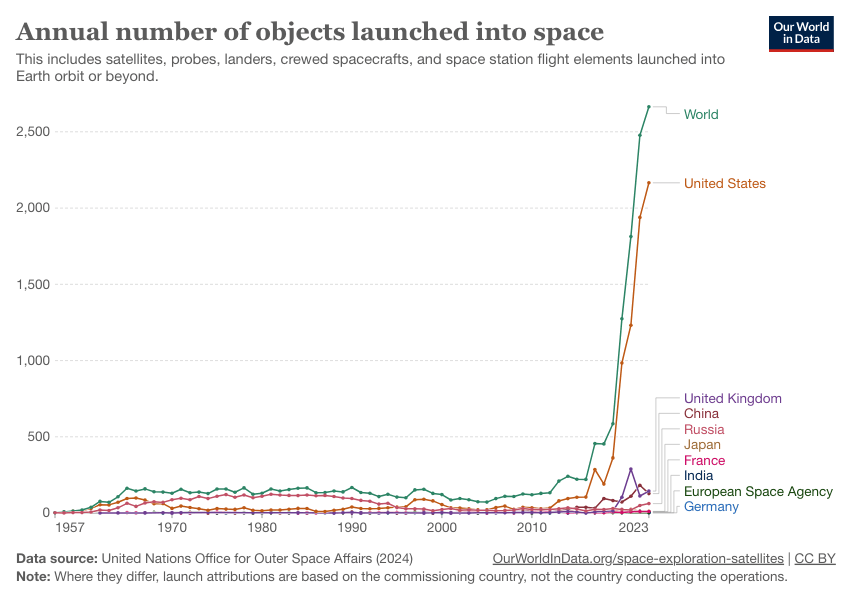

The advent of reusable rockets from SpaceX has led to cheaper space launches and has sparked an era of space re-exploration that is no longer limited to government entities. As such, this has democratized access to space, enabling a surge of private companies to enter the market. With the current tailwinds for space, including the exponential reductions in launch costs, advancements in satellite technology, and the increasing reliance on space-based infrastructure, space will prove to become immensely valuable.

One immediately relevant example is offering a unique avenue of collecting data for the current AI boom through LEO space satellites.5 Another is space-based infrastructure for global communications to achieve ubiquitous internet coverage across the globe. Surprisingly, only 66% of the world’s population has access to the internet. What about the remaining 34%?

Allowing access and capturing this unmet and underserved market in poorer regions will enable unprecedented access to information, education, and economic opportunities. Already, SpaceX’s Starlink and Amazon’s Project Kuiper have set out to accomplish this.

But it is beyond-Earth applications in resource extraction and off-world manufacturing that will hold the largest value for space. If done properly, humans will fundamentally change how we extract, produce, and manufacture new goods.

Once Interlune mines helium-3 from the moon or AstroForge extracts billions – even trillions – of dollar amounts of rare earth metals from asteroids, the ability to produce technologies that require rare and valuable materials will grow superlinearly. For instance, helium-3 shortages in running physics research experiments and nuclear fusion will be eliminated. The need for silicon, indium, gallium, vanadium, and other rare earth metals to expand clean energy solutions through solar panels, autonomous vehicles, and battery systems will be easily fulfilled.

And while resource extraction will change the way we extract, space-based manufacturing will change the way we produce.

Microgravity environments offer unique conditions for producing materials and biological products that are simply difficult or impossible to manufacture on Earth.6 This includes high-purity pharmaceuticals (pursued by Varda - read my memo here) and future 3D-printed human organs (pursued by 3D Bioprinting Solutions). As this sector matures, more industries can capitalize on space-based manufacturing processes at lower costs.

However, several factors hinder investments in space startups:

- Almost all space startups have not shown a definite path to profitability and sustainable margins to be appealing investments. This will likely change as SpaceX scales and brings down the cost of building in space.

- Currently, space companies are largely valued on hype, momentum, and a promise of a better future, but it is important to understand the value is largely derived from feasibility. And feasibility is growing stronger by the day.

- Space startups often operate in long development cycles, and thus are not well suited for venture capital investment. The space industry needs responsible, patient capital to succeed in the long term, not irrational FOMO. Government funding, contracts, and demand stimulation will be increasingly important to grow the space economy.

Finally, as the world enters the Second Cold War, the defensive applications of space technologies will prove significant. Already, the military has contributed massive amounts of capital to space startups with even just a hint of strategic importance, such as Varda’s hypersonic testbeds.

Promising companies in the cosmic infrastructure space:

- Interlune

- AstroForge

- Varda

- Array Labs

- Astranis

- Care Weather

- SpaceX (Read my memo here).

Alternative Compute

Computation and networking equipment already account for over 20% of global electricity demand. And that was before AI. Now, global electricity demand for data centers alone – a once small subset of the computation and networking bucket – is expected to reach 20% by 2035.

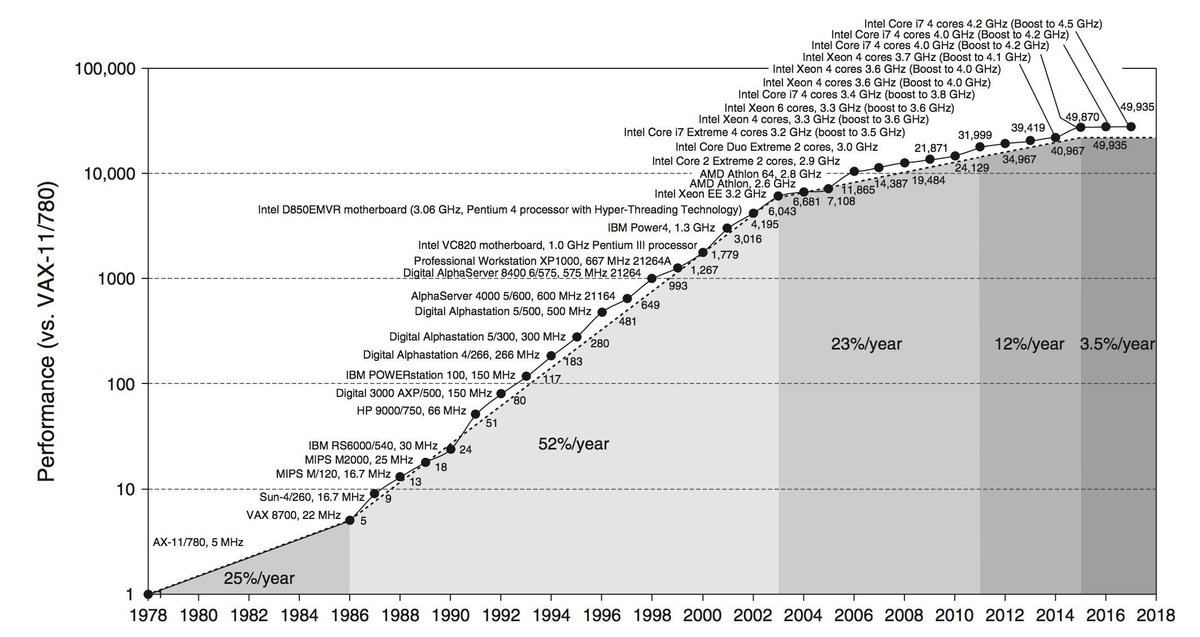

To make matters worse, scaling laws for compute are coming to an end. With that, comes an end in efficient and scalable compute.

This comes at a time when efficient and scalable compute is more necessary than ever for the development of AI. A world without cleanly supplied compute at scale will halt all progress in frontier software until otherwise addressed. And it is a societal, geopolitical, and economic imperative that alternative compute technologies must be developed.

Alternative compute technologies will come from three major directions:

- Modernized materials.

- Advancing architecture.

- Foreign frameworks.

Modernized materials will enable new designs and implementations of existing chips. Already, research has identified new material candidates for replacing silicon. Additionally, the mining and production of silicon and other rare earth elements in semiconductors have significant environmental impacts – alternative materials can reduce this environmental footprint, adhering to current and future regulations surrounding climate and sustainable materials in the future.

However, this is a longer-term pursuit, and thus various companies7 have decided to capture the low-hanging fruit of advancing the architecture for compute. Most chip architectures are based on the 80-year-old von Neumann architecture, which suffers from a memory gap bottleneck. Thus, designing new chip architectures that bypass this bottleneck will offer rapid, short-term advances in compute. Groq’s LPU chips provide blazingly fast inference speeds. Google’s TPUs provide efficient tensor-based calculations. More developments in chip architecture will continue to push compute power along.

The biggest value and advancements in alternative compute will ultimately come in the form of foreign computing frameworks that entirely rethink and redesign what a chip is.

Various companies, such as Lightmatter and Ayar Labs, are working on photonics-based computing, which promises high-volume and low-cost manufacturing at scale while being power efficient. More ambitiously, Cortical Labs are working on biological computing that completely bypasses any and all inefficiencies associated with silicon and nanoscale developments. Rather, biologics-based computing offers a novel type of compute that allows for efficiency and performance gains by a factor of a million while reducing manufacturing complexity and reliance on overseas manufacturing from TSMC – avoiding potential geopolitical tensions that may arise. Other forms of computing, including spintronics, magnonics, DNA-based, and reversible computers are being developed as well.

Microsoft, Google, and Meta seek to invest an additional $750 billion of capital over the next 5 years in AI. As applied AI and other computationally intensive tasks continue to develop, providing energy-efficient and scalable compute will be a valuable resource for any company.

Promising companies in the alternative compute space:

Manufacturing and Materials

While mechanical engineering seeks to push engineering to its bounds, it is the engineering of new materials that defines such bounds. These new materials will be essential to the future of manufacturing.

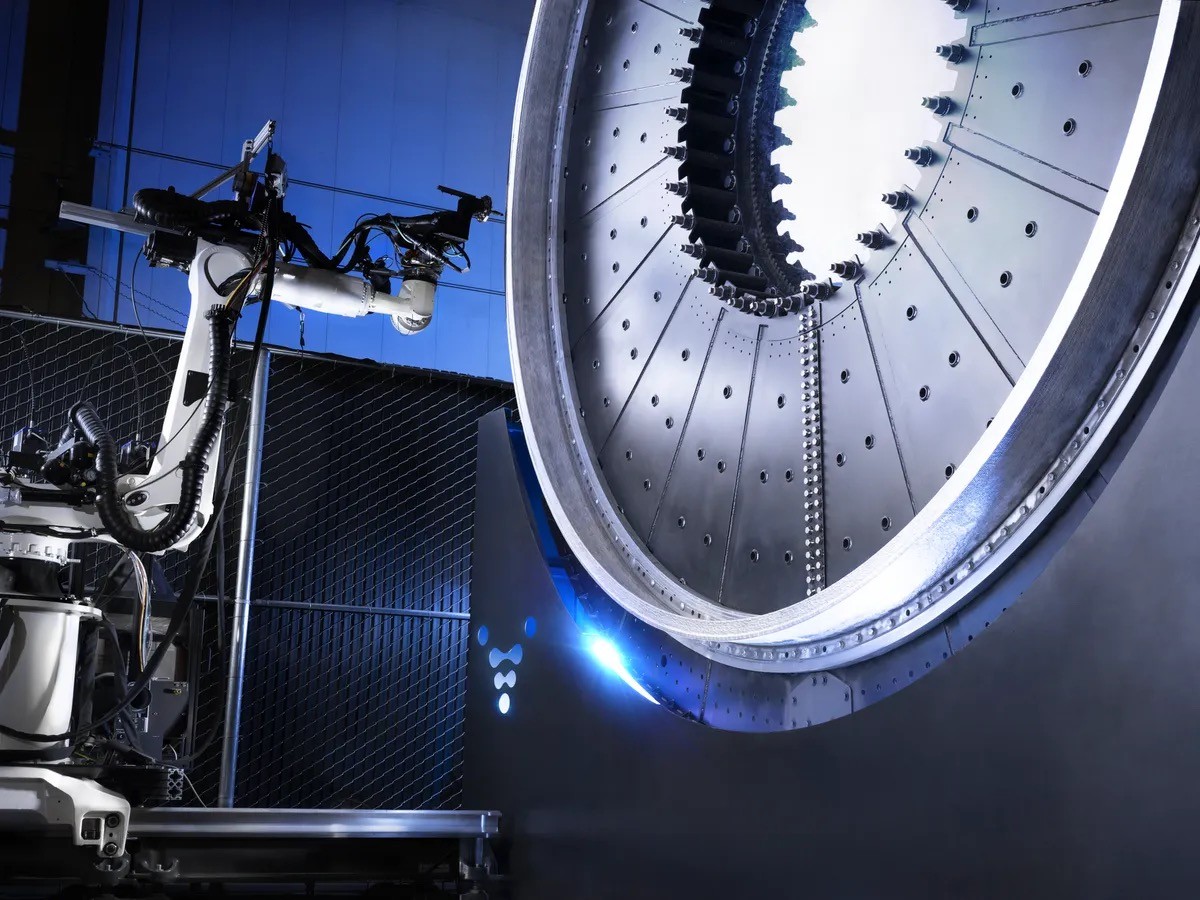

In 2024, NASA demonstrated a stable rotating denotation engine, which is simpler and more compact than a traditional engine. Although the mechanical design of the concept is not new, it was only the synthesis of a novel GRCop-42 (Copper Chromium Niobium) alloy that allowed the engine to withstand extreme temperatures.

Materials limit mechanical designs. Thus, new materials unlock new designs.

For a long time, no new major materials science or technology had been developed. It has been over 50 years since the revolutionary materials of nylon and synthetic polymers were developed – now the 2nd most produced material and found in almost every product we use today. But that’s changing now.

Future improvements in humanity will come from inventing new materials to build from. For that reason, I am heavily bullish on nanotechnology and bioengineered-derived (synthetic biological) materials, for they promise to reshape the physical basis of our built environments:

- Stronger and lighter building materials, which is crucial for the aerospace industry.

- Better efficiencies of carbon capture materials for combating climate change.

- Better radiation shielding during space missions, supporting interstellar survival.

- Enhanced stealth technology for military aircraft to protect our nation’s borders.

- Easier development of tissue engineering, unlocking cost-effective artificial organs.

- Biodegradable plastics and other industrial components offer long-term sustainability.

Combined with the advancement of manufacturing methodologies, we will change the way we build everything.

The development of additive manufacturing in the 1980s and the widespread use of 3D printing in the 2010s have enabled faster hardware iteration cycles, fundamentally changing the unit economics of some industries (and ushering in an era of deeptech). For instance, Relativity Space 3D-printing technology for rockets will reduce the cost, complexity, and time to develop launch-ready rockets.

Imagine churning a rocket every month instead of every year!

These innovations will not only redefine the physical limits of our built environments but also create more sustainable, efficient, and adaptive solutions to meet the challenges of tomorrow. Manufacturing emits 29% of the world’s carbon emissions. New technologies can and will bring that number down.

By investing in and supporting these technologies, we can unlock a new era of human prosperity.

Promising companies in the manufacturing and materials space:

Energy Expansion

Similar to improved materials and improved methodologies to build, new sources of energy will enable us to build technologies without accounting for the huge bottleneck in supplied energy. Already, this theory is being realized with the emergence of AI, where the bottlenecks are in materials and energy.

In a way, the expansion of energy will interact and accelerate all other technologies on the planet.

The expansion of cheaper, cleaner energy will decrease the cost of all the goods and services that use energy in their production and will enable us to produce more goods in ways that are only economical when energy costs are low, including engineered biology, novel materials, cosmic infrastructure, and alternative compute methods.

I define the expansion of energy in two ways:

- The increase in overall energy from clean sources.

- The increase in energy efficiency in existing technologies.

Both are constantly being pursued, albeit with limited success. But we’re hitting the inflection point of energy technology.

- Solar panel costs have dropped 5x since 2010 and are projected to grow more cost-effectively as spending on solar is up 43% year over year. Right now, 3-4 acres of solar are being deployed per minute!

- Nuclear fusion technology has also made rapid progress. In February 2024, scientists set a record for running a tokamak at 69 mega-joules of fusion energy for five seconds, and two months later, South Korea’s artificial sun set a record for sustaining plasma of 100 million degrees for 48 seconds. Roughly two months after, a nuclear fusion experiment set another record for magnetically confining reactor plasma. Nuclear fusion is no longer a moonshot concept. It’s a matter of when.

- Battery tech enabled the smartphone revolution. But batteries are still improving rapidly: the cost of batteries has fallen by a factor of 42 since 1991. That means a $7,523 battery in 1921 costs only $181 in 2018. These days, battery tech is enabling four massive verticals: the electric vehicle revolution, reliable power storage for solar and wind plants, general robotics, and the advancement of military drones for warfare and reconnaissance.

Companies working to achieve either option 1 or option 2, or piggybacking on their success, will unlock the feasibility of many out-of-reach technologies. Once energy becomes abundant and cheap enough:

- Electric planes running on turboelectric engines efficient at every speed will unlock affordable supersonic flight anywhere in the world.

- Energy-efficient robots could be developed with less charging downtime.

- Interstellar survival shelters would be viable as battery packs grow denser and lighter.

- Any and all water shortages can be solved through continuous desalination processes.

- Food production that is cheaper than agriculture could be achieved.

- Space travel could theoretically run on nuclear fusion technology for deeper explorations.

- Metal refinement would be infinitely cheaper and faster to produce, leading to a boom in infrastructure development.

The climate crisis is 100% the single most important problem of our time, but it’s also the biggest opportunity of our time. All things considered, all entrepreneurs should be working on expanding clean energy and efficientizing existing technologies.

Finally, there has long been a subconscious understanding that the advancement of energy can bring about new eras.

The Industrial Revolution was in part brought about by the use of steam engines, a new form of generating energy. The Nuclear Age has brought about a new, yet destructive, way to deploy and synthesize energy. A new age in energy will come soon, and along with it, near infinite growth potential for humanity.

Promising companies in the energy expansion space:

Anti-Sectors

And finally, a quick run-down on sectors that I don’t believe in.

Applied AI Apps

If you built it over a weekend, so can someone else… if not in a weekend, then in a month. Any app that is simply a GPT wrapper or purely implementing X feature of AI for X use case fails to create a strong moat in the beginning. And I find it difficult for a venture to provide its core value long enough to generate such a deep moat without being killed off first by OpenAI or Google and the other dozens of massive companies building their own AI models.

Similarly, I believe the value of AI on the application layer will accrue to zero as open-source models become increasingly performant and accessible. Ventures working on generative AI models and applications will face extreme competition not only due to the ease of entrants, but also pressure from the Big 4: Microsoft, Amazon, Google, Nvidia, and all of their partnerships (such as OpenAI, Anthropic, Perplexity, and Mistral). I find luck a big factor in these ventures and would rather not invest on that basis.

The only value of applied AI startups is those that can accumulate data from places where it is prohibitively cost, time, and or capital-expensive. Unfortunately, this is extremely hard to do unless you are OpenAI and have the money to sign deals with Reddit, Apple, and Stack Overflow.

Finally, as of 2024, I think AI is in a massive bubble. The AI industry spent $50 billion on AI chips for a return of $3 billion in revenue. The hype and FOMO over AI technologies worry me.

Rather, I seek to move up the stack – away from foundational models and towards building AI infrastructure and data, where I believe ventures can build durable value.

Consumer Software

Consumer software is a tricky field. Great consumer products usually ride on a wave of enabling technologies – from the invention of the cellphone to the distribution of high-speed internet. Therefore, my feeling is that finding a successful consumer software is generally dependent on outside underlying technologies. Plus, I find that a major challenge with consumer software and goods is marketing the product, which comes with the non-technical challenge of being able to understand consumer psychology at a deeper level. I don’t!

So I tend not to dabble in this field, even though the world’s largest companies are inherently consumer-oriented (Microsoft, Apple, Google, Amazon, Facebook, Uber, Doordash, etc8) In fact, consumer companies are more than twice as likely to exit at a $10B+ valuation!

What do you pay for on your phone?

A question I always ask people who want me to critique their consumer app idea is, “What do you pay for on your phone?”

Besides the very popular apps like Spotify and Netflix, the answer is almost always none. And oftentimes, their answer to “How are you going to overcome this challenge?” is also none. If you are going to seriously build in this space, answer this question first. Why will users pay for a relatively new or unknown app when they don’t pay for anything else at that scale?

I am especially against consumer social software. BeReal’s and Clubhouse’s rapid rise and fall in the 2020s solidified that most social apps cannot break through the established networks of Twitter, Instagram, or Facebook. Any software that aims to create a “social platform” for X will face a long and difficult road ahead.

However, the AI wave is here. Regardless if it is a massively overhyped bubble, consumer software built on top of AI will likely emerge as the winners among all consumer software ventures. In a way, any niche that integrates natively with AI will likely hold first-mover advantage – I’m particularly excited for an AI-first browser (ahem, possibly Arc) and an AI-first code-editor (ahem, Cursor). Though usually what happens is that pioneers are oftentimes the losers. Then the other guys come behind it and figure out what they did wrong. Although I can see how Google could be seen as the first-mover of search, and VSCode as the first-mover of IDEs.

Web3, Blockchain, and Crypto

Finally, I do not understand web3, blockchain, and crypto technologies at a level I feel comfortable investing in. But with the limited knowledge that I do have, I find that:

- Web3, blockchain, and cryptocurrency technologies face significant scalability challenges that would likely hinder their widespread adoption. This is because, at their core, decentralized mechanisms are inherently inefficient. According to Coinbase, blockchain’s reliance on proof-of-work and proof-of-stake protocols requires substantial computational resources that limit possible transaction throughput.9

- The scope of viable blockchain applications is constrained primarily to decentralized finance (DeFi) and FinTech applications. There are just too few compelling use cases that justify the complexity and capital costs of implementing blockchain technologies.

Footnotes

-

Moving forward, I expect geopolitical forces to be highly influential in the success of emerging companies. The forces that regulate the world have subtly shifted: no longer are we in a world policed by the United States. Rather, we are in the midst of a power transition towards a multi-world order consisting of China, and soon, India. In reactance, the US has shifted towards protectionist technologies (SpaceX, Anduril, Palantir) and geopolitically influenced policies (see recent US export regulations surrounding Nvidia and the semiconductor industry and the US Chips Act which seeks to bolster domestic chip manufacturing). This, in turn, has produced a more nationalistic culture within America, with one clear example being the American Dynamism movement. ↩

-

I subscribe particularly to the American Dynamism movement and the effective acceleration (e/acc) movement. Many of my identified sectors are influenced by my beliefs in those movements. ↩

-

According to Porter’s Five Forces model, deeptech ventures naturally make it hard for new entrants to enter the market. Combined with low substitutes in which buyers have limited options and suppliers compete for the business, deeptech ventures from the ground up are poised to dominate the future market. ↩

-

As I’ve written in Gravitational Ambition, “But think about this. It’s almost easier to build a hard, ambitious company than an easy, boring one. Wharton MBA students are building the next “find-places-for-you-and-your-friends-to-hangout.” Nobody cares. But if you’re building a drug manufacturing factory in space or reusable rockets to bring consciousness to Mars and beyond, people want to help you because they want to be a part of this interesting thing.” ↩

-

For instance, Planet Labs provides real-time, high-resolution imagery of the Earth; ICEYE uses SAR observation capabilities; and Hydrosat with thermal and infrared imagery. ↩

-

Reasons include gravitationally-induced defects and the natural existence of a perfect vacuum. This is extremely important to produce advanced materials such as ZBLAN fiber optics. ↩

-

Intel is currently developing 3D transistor structures such as FinFET. IBM is pursuing a neuromorphic computing architecture through its NorthPole chip. Astera Labs builds on top of the open-source RISC-V chipset implementation. ↩

-

These companies started consumer-oriented and developed extremely successful moats. If you want to build a consumer-oriented company, study how they used emerging technologies to build deep moats. Apple succeeded with its previously impossible hardware designs and now operates with highly walled gardens. Google because they were able to predict where the internet was heading towards, and now operates with an information and network moat. If you’re going to start a mental-health tracking app – how does it play off emerging technologies, and what moat can you build around it in the future? ↩

-

For example, Bitcoin’s decentralized network can only handle 7 transactions per second while Visa’s centralized network handles 65,000 transactions per second. A big difference with no proven and efficient technology to overcome this gap! ↩